The Trumbull County Property Tax System Can Be Confusing For Homeowners And Investors. Many Residents Overpay Or Miss Exemptions Because They Don’t Fully Understand How The Trumbull County Tax Assessor Works. The Assessor Evaluates Properties, Maintains Records, Manages Exemptions, And Oversees Appeals. Learning How These Processes Work Helps Residents Take Control Of Their Taxes And Avoid Common Mistakes.

Many Property Owners Fail To Use Available Exemptions Or Credits, Leading To Over Payment. Regularly Checking Records, Reviewing Notices, And Consulting With The Trumbull County Tax Assessor Office Can Save Money And Reduce Stress. Using Resources Like Online Portals, GIS Maps, And Public Records Helps Residents Plan For Taxes, Protect Investments, And Ensure Fair Contributions To Local Services.

How Trumbull County Property Assessment Works

The Trumbull County Tax Assessor Evaluates Properties Regularly To Ensure Fair And Accurate Taxation. Residential, Commercial, And Vacant Properties Are Assessed Based On Market Value, Improvements, And Ownership Records. Understanding This Process Helps Residents Know Why Their Taxes Change And How Assessments Affect Financial Planning.

Property Owners Should Review Assessment Notices Carefully And Verify Information Through Online Portals Or By Consulting The Assessor’s Office. This Proactive Approach Prevents Mistakes, Helps Claim Eligible Exemptions, And Ensures That Residents Only Pay What Is Fair.

Being Informed About Assessment Procedures Allows Residents To Plan Their Finances Better And Avoid Surprises. Regular Check-Ups And Communication With The Trumbull County Tax Assessor Office Can Save Time, Money, And Reduce Stress.

Who Is The Trumbull County Tax Assessor

The Trumbull County Tax Assessor Oversees Property Evaluation Across The County. They Ensure Every Property Owner Pays Fair Taxes Based On Accurate Assessments. Many Residents Don’t Fully Understand This Role, Leading To Overpayment Or Missed Exemptions. The Office Maintains Detailed Records, Tracks Ownership Changes, Handles Exemptions, And Provides Guidance For Appeals. Understanding This Role Helps Protect Finances And Take Advantage Of Legal Benefits.

Top Responsibilities Of The Tax Assessor

- Property Assessment: Evaluating Market Value For Homes And Businesses

- Maintaining Records: Ownership, Improvements, And Zoning Information

- Managing Exemptions: Seniors, Veterans, Disabled Residents, And Farmers

- Handling Appeals: Guiding Residents Through Disputes And Corrections

- Transparency: Providing Tools, Online Portals, And Consultations

Ignoring These Duties Can Lead To Overpayment Or Missed Benefits. The Assessor Ensures Fair Taxation And Proper Funding For Local Services.

How Property Assessment Works In Trumbull County

Assessment Involves Inspecting Properties, Reviewing Sales, And Evaluating Improvements. Residential, Commercial, And Vacant Properties Are Reassessed Regularly. Updates Include Construction, Demolition, And Ownership Transfers. Accurate Assessment Prevents Overpayment And Provides Reliable Data For Planning. Understanding The Process Allows Property Owners To Challenge Incorrect Assessments And Claim Exemptions.

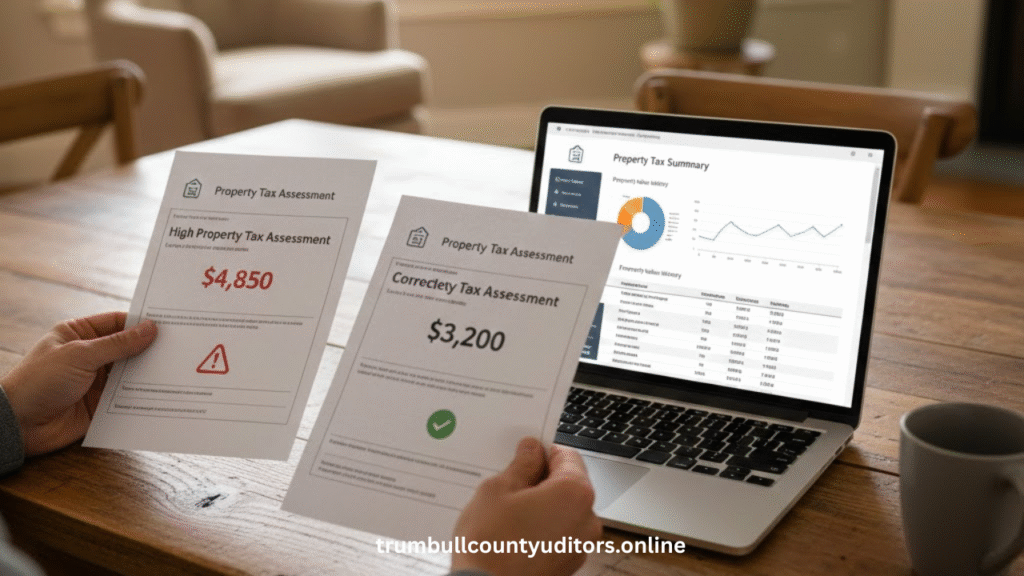

Common Property Tax Mistakes To Avoid

- Ignoring Reassessment Notices

- Missing Exemptions For Seniors Or Veterans

- Failing To Verify Property Records

- Overlooking Errors In Valuation

- Delaying Appeals

Many Residents Overpay Annually Due To These Mistakes. Engaging With The Trumbull County Tax Assessor And Using Available Tools Helps Prevent Errors.

How Trumbull County Taxes Are Calculated

Taxes Are Determined By Multiplying The Assessed Value Of A Property By The Local Tax Rate. This Simple Calculation Forms The Basis Of Every Property Owner’s Tax Bill And Ensures That Contributions Are Distributed Fairly Across The Community. Understanding How This Figure Is Derived Helps Residents Know Exactly What They Owe And Why.

Exemptions And Credits Play A Key Role In Reducing Tax Obligations For Eligible Residents. Seniors, Veterans, Disabled Individuals, And Agricultural Landowners Can Benefit From Specific Programs That Lower Their Tax Burden. Applying For And Maintaining These Exemptions Requires Awareness Of Deadlines And Documentation, Which Can Save Property Owners Significant Money Each Year.

Accurate Assessment And Knowledge Of Tax Calculations Prevent Overpayment And Potential Legal Issues. Being Informed Allows Property Owners To Plan Finances Efficiently, Avoid Mistakes, And Make Strategic Decisions Regarding Property Investments. Regularly Reviewing Assessment Notices And Consulting With The Trumbull County Tax Assessor Office Ensures Fairness And Transparency In The Taxation Process.

Sample Property Tax Calculation Table

| Property Type | Assessed Value | Tax Rate (%) | Annual Tax ($) |

|---|---|---|---|

| Residential Home | $250,000 | 2.5% | $6,250 |

| Commercial Building | $500,000 | 2.5% | $12,500 |

| Vacant Land | $75,000 | 2.5% | $1,875 |

This Table Helps Property Owners Understand How Taxes Are Calculated And Plan Accordingly.

Tools And Resources From The Tax Assessor

- Online Property Search – Check Values And Ownership

- Public Records – Sales History And Assessment Data

- Assessment Guides – Step-By-Step Instructions

- Exemption Applications – Seniors, Veterans, Disabled, Farmers

- Appeals Forms – Structured Challenge Process

- Maps & GIS Resources – Visualize Property Boundaries

- In-Person Consultation – Staff Assistance For Questions

Using These Resources Helps Residents Avoid Mistakes And Manage Taxes Effectively.

Handling Appeals And Disputes Effectively

Filing Appeals Requires Documentation Such As Appraisal Reports, Comparable Sales, And Property Records. Late Or Incomplete Filings May Be Rejected. The Trumbull County Tax Assessor Provides Guidance For Correct Submission. Avoid Missing Deadlines Or Ignoring Notices. Early Engagement Ensures A Fair Chance To Correct Errors And Reduce Taxes.

Importance Of The Tax Assessor For Residents

The Assessor Directly Impacts Funding For Schools, Roads, And Public Services. Accurate Assessments Ensure Fair Contribution And Build Trust In Government. Neglect Or Mistakes Can Lead To Overpayment Or Reduced Services. Understanding This Role Helps Residents Make Strategic Decisions And Advocate For Fair Taxation.

Conclusion Protect Your Property And Finances

The Trumbull County Tax Assessor Is Essential For Fair Property Taxation. Understanding Their Responsibilities, Using Tools, And Staying Informed About Exemptions And Appeals Helps Residents Avoid Overpayment And Legal Complications. Engaging With The Office Empowers Property Owners To Protect Investments And Make Smart Financial Decisions.

Accurate Assessments Affect Community Funding For Schools, Roads, And Services. Mistakes Or Ignorance Can Lead To Long-Term Financial Issues. Regularly Reviewing Assessment Notices, Understanding Tax Calculations, And Seeking Guidance Ensures Compliance And Fair Contribution.

Proactive Property Management, Awareness Of Common Mistakes, And Timely Appeals Strengthen Financial Security. The Trumbull County Tax Assessor Office Provides Transparent Processes And Resources To Take Control Of Taxes, Avoid Errors, And Maintain Trust In The System.

10 FAQs About Trumbull County Tax Assessor

- How Can I Contact The Tax Assessor?

Visit The Office Or Call During Business Hours. - What Exemptions Are Available?

Seniors, Veterans, Disabled Residents, And Farmers May Qualify. - How Often Are Properties Reassessed?

Usually Every Few Years Depending On Policy And Market Changes. - Can I Appeal My Property Assessment?

Yes, Through The Formal Appeals Process With Documentation. - Where Can I Access Property Records?

Online Portals And The Assessor’s Office Provide Public Access. - What Happens If I Ignore Notices?

Late Appeals May Be Rejected Leading To Overpayment. - Do Commercial Properties Follow Same Rules?

Yes, But Valuation Methods May Differ Slightly. - How Are Tax Rates Determined?

Local Authorities Set Rates To Fund Schools And Services. - Can Property Improvements Affect Taxes?

Yes, Renovations Or Construction Can Increase Assessed Value. - Is Assistance Available For First-Time Homeowners?

Yes, The Assessor Provides Guidance, Tools, And Consultation.